As one of the main ways of intellectual property capitalization, ‘patent right investment’ means the way in which the patentees may use patent right to make capital contributions based on their appraised value according to law and obtain the shareholder qualification of the newly established target company or the share capital when the target company issues new shares. Driven by some policies, such as the effective ‘Company Law’ (shareholders can use intellectual property to make capital contributions) and ‘the Program for the Division of the Key Tasks of the Several Opinions of the State Council on Building a Powerful Intellectual Property Nation under New conditions’ (strengthening the use of intellectual property rights),there is an increasing number of patent right investment cases in commercial activities. Although these investment activities brought related parties greater benefits, they also brought about endless stream of related disputes in recent years. In order to improve the success rate of patent right investment, it is particularly important to identify risks and develop prevention strategies in the early stage.

In this article, we would summarize and analyze the related risks and preventive measures from three aspects: due diligence, patent value evaluation and the proportion of the investment provided.

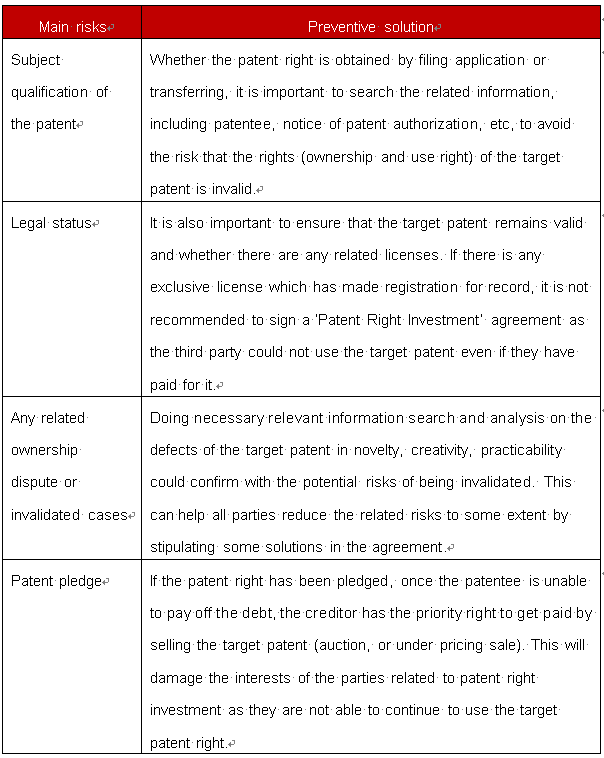

1. Due diligence

As the patent right is time-limited and revocable, the stability of the target patent right will directly affect the success rate of the patent right investment. Therefore, due diligence has an important impact on protecting the interests of all parties before the substantive stage. Hereunder are the main points of risks and strategies.

2. Patent value evaluation

In order to ensure the relatively reasonable value of the target patent and avoid the patentees or investors making false claims on the patent price, it is necessary to evaluate the value of the target patent and technology reasonably to protect the interests of related parties.

In practice, the following factors are normally involved in Chinese patent value evaluation system:

(1) The patent technology itself: the degree of technology innovation, technology maturity, advanced level of the patented technology, development prospect, and the possibility of being replaced, etc,.

(2) Target market and industry: market competition level, the capability of market expansion and growth, market scale, the degree of patent industrialization, the adaptation to the state policy, and application scope, etc,.

(3) Legal: types of patent (There are many differences among inventions, utility model, and industrial design, including the procedure for examination and approval, protection scope, and duration of patent, etc,.), the subject matter of the patent right investment (patent right, patent application right, or patent use right), the protected area of the patent and patent length (the duration of patent protection), the situation of annuity payment and the licensing status of the target patent, and its infringement and invalidity dispute.

The evaluation of patents is a process which can control the risk, so an appropriate patent evaluation is essential.

3. The proportion of the investment provided

The provisions of ‘Company Law’ on the proportion of non-monetary contributions have been revised many times, changing from ‘the evaluated amount of the industrial property right or non-patent technology should not be more than 20% of the total registered capital of the Co. Ltd.‘, ‘The amount of monetary capital contribution of all the shareholders or promoters of a company shall be no less than 30% of the registered capital of the company.‘ to the current policy which no longer imposes any restrictions on the proportion of non-monetary contributions. This fully demonstrates that the government has recognized the importance of patent right investment for the establishment of some high-tech enterprises.

On the other hand, the proportion of the patent right investment needs to be controlled to some extent as it can have an influence on a company’s operation, which requires a series of production factors, such as equipment, employees. The higher the proportion of the patent right investment is, the greater the risk the company will face. Therefore, the consideration of the proportion of the patent right investment is a trade-off between the expected benefits and risks that the patent capital can bring to the company. It is necessary to control the proportion to avoid the non-essential risks brought by the patent right investment.

4. Summary

In addition to the above risk points, there are still some issues that need to pay attention in the practice of patent right investment, such as the tax burden, the registration process, the impairment risk of patent technology (the impact of technology advancement). Although there may be huge financial gain for related parties, there are also many complicated problems and risks.

In conclusion, in the practice, relevant preventive solutions and relatively reasonable clauses should be stipulated in the agreement to avoid potential disputes during the whole implementation process, and thus improve the success rate of patent right investment.

Follow us