Abstract

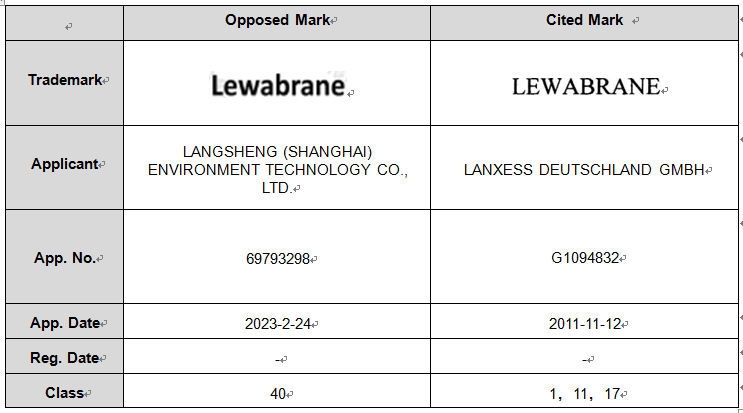

We, Kangxin Partners, P.C., filed an opposition action against the trademark,  (No. 69793298 in Class 40) (“the opposed mark”) on behalf of LANXESS AG (“the client”) on August 8, 2023. The National Intellectual Property Administration, PRC (“CNIPA”) examined the case and decided to reject the opposed mark for registration.

(No. 69793298 in Class 40) (“the opposed mark”) on behalf of LANXESS AG (“the client”) on August 8, 2023. The National Intellectual Property Administration, PRC (“CNIPA”) examined the case and decided to reject the opposed mark for registration.

Background

LANXESS AG is a leading specialty chemical company based in Germany, with a rich history dating back to 1863. It has a global presence with over 50 subsidiaries and joint ventures in various countries around the world. The client's global footprint allows it to serve customers in diverse industries, including automotive, construction, electronics and agriculture, with high-quality specialty chemicals and advanced materials. The client is committed to developing sustainable solutions that help to address global challenges such as climate change, resource scarcity, urbanization and water pollution. With a strong focus on innovation, sustainability, and customer satisfaction, the client continues to drive forward as a leading player in the global specialty chemical market.

The client has the international registration of  in Class 1, 11 and 17 in mainland, China, which is managed by the subsidiary, LANXESS DEUTSCHLAND GMBH. Through the client's long-term use and promotion, their mark

in Class 1, 11 and 17 in mainland, China, which is managed by the subsidiary, LANXESS DEUTSCHLAND GMBH. Through the client's long-term use and promotion, their mark  has obtained certain reputation among the relevant public in mainland China. The opposed mark is totally same as our client’s registered mark

has obtained certain reputation among the relevant public in mainland China. The opposed mark is totally same as our client’s registered mark  and the opposed party also filed several marks that are similar to the client's other marks with high reputation, such as "LANXESS", "朗盛" and

and the opposed party also filed several marks that are similar to the client's other marks with high reputation, such as "LANXESS", "朗盛" and  . Upon communication with client, we were entrusted to file opposition action against this trademark.

. Upon communication with client, we were entrusted to file opposition action against this trademark.

The comparison of the marks is as below:

Key Issues

In the opposition, we mainly argued that:

1) The opposed mark was filed in obvious bad faith by coping and imitating the cited mark, which violates the principle of good faith;

2) The opposed mark is same as the cited mark, and their goods/services are highly connected with each other, the registration and use of the opposed mark over the closely related services is more likely to cause confusion and misleading among relevant public.

On April 26, 2024, the CNIPA issued the decision: the designated services of the opposed mark and the designated goods of the cited mark have certain differences in consumer group and service place, thus, the marks of both sides do not constitute "similar marks over similar goods/services". But according to the evidence submitted by the opponent and the ascertained fact, except the opposed mark, the opposed party also filed many marks in multiple classes that are same or similar to the marks of the opponent and its affiliates, partial marks have been rejected by the CNIPA or opposed by relevant right holders. The opposed party didn't make reasonable explanation on the above facts, in combination with the fact that the opposed mark is same as the cited mark, the CNIPA holds that the opposed party has subjective malice in copying and imitating others' trademarks, such action not only damages the fair market competition, but also disrupts the normal management order of trademark registration, violating the legislative spirit of the Trademark Law on prohibiting trademark registration by deceptive or other illegal means. Therefore, the opposed mark should be rejected for registration according to Article 30 of Chinese Trademark Law.

Inspiration of the Case

From this decision, we can learn that the CNIPA now makes major effort to crack down the malicious registrations, which will give more protection on the real trademark owners’ rights. Even though the client has no earlier right over same or similar goods/services, we may search deep into the other party's bad faith with supporting evidence in the opposition / invalidation actions so the CNIPA can rule in our side.

On the other hand, Chinese market becomes more and more important and popular in recent years, and more and more brands are paying high attention to the Chinese market. The brand owners should make early preparations for trademark protection before entering the Chinese market. We have seen many foreign brands which only cover their key goods / services on sale when filing trademark applications, which means that their trademark only has limited protection scope. To protect the distinctiveness of the brand in the market and reduce potential risk of confusion and misleading to be caused to the consumers, the true owners of the brands have to spend much efforts, energy, costs and time to clean up the bad-faith registrations, and when they want to enlarge the business scope and register trademarks over additional goods / services in China, the bad-faith registrations will bar their applications.

Thus, we recommend the brand owners filing defensive applications over related goods / services in China timely to 1) bar the subsequent bad-faith applications filed by third parties; 2) provide assurance for future business expansion; and 3) avoid possible infringement claims against the real owner (if the owner plans to use the mark over additional goods / services in China). China is a “first-to-file” country, meaning that generally, the first person to file a trademark application will have superior rights over that trademark. So we recommend the applicant filing defensive applications over related goods / services as early as possible.

We now offer two options of communication, i.e. traditional email instruction and our Kangxin IP Platform (https://eservice.kangxin.com), which both provide the same substantive services by our trademark attorneys, with the only difference in instruction manners. Since our platform is more efficient by automatic docketing, standard goods / services recommendation and automatic generation of POA as well as other smart tools, it is treated as a fast track, and we offer more favorable quotation for all services via our platform as compared with our standard fee charges.

Follow us